Which of the Following Is Not True About Closing Entries

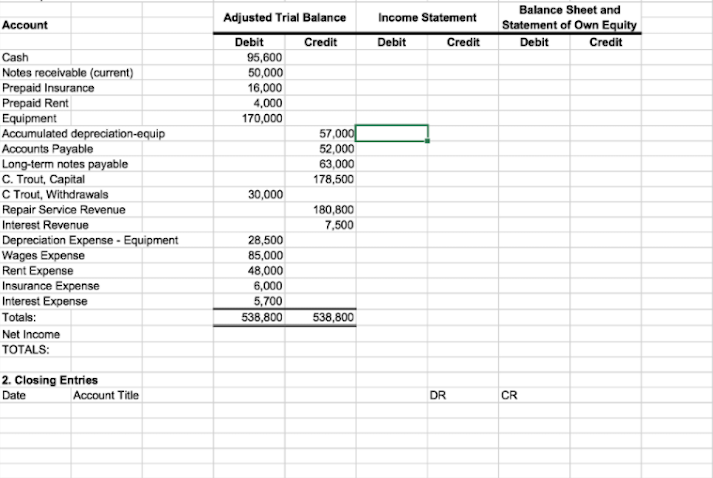

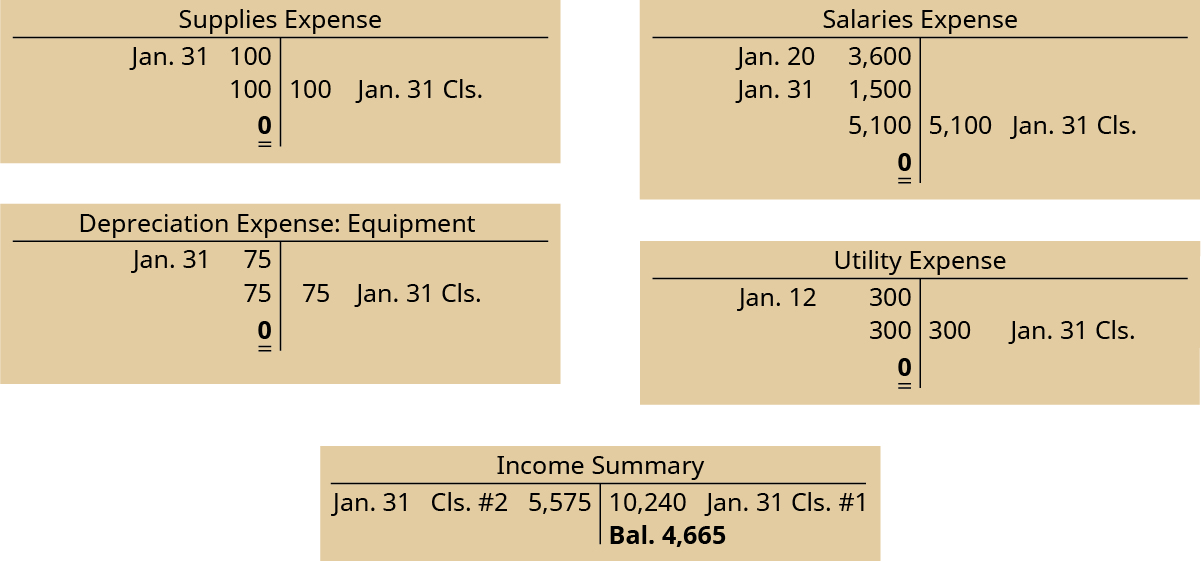

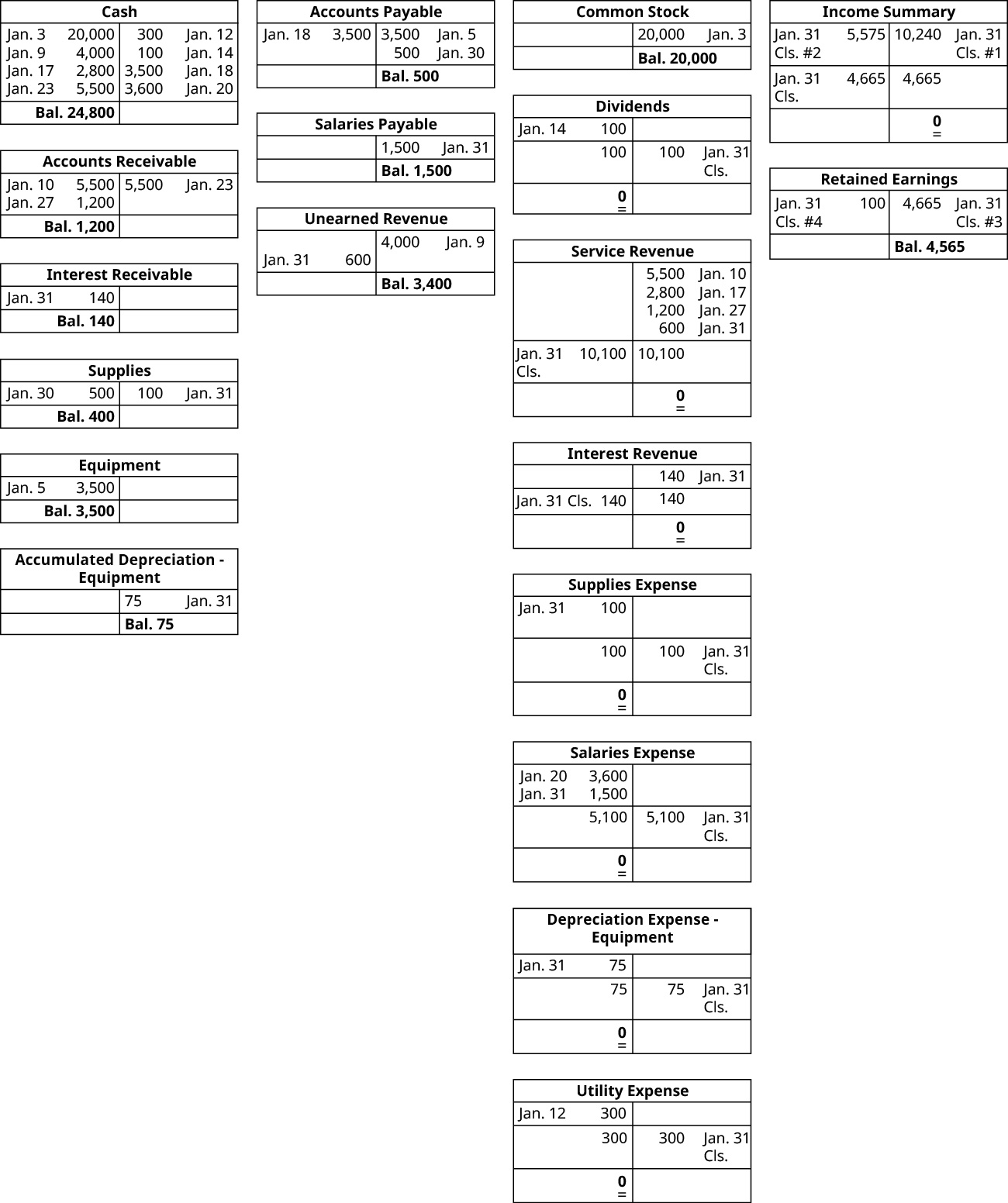

Temporary accounts include revenue accounts expense accounts and the dividends account. The expenses that are incurred to obtain merchandise inventory increase the cost of merchandise available.

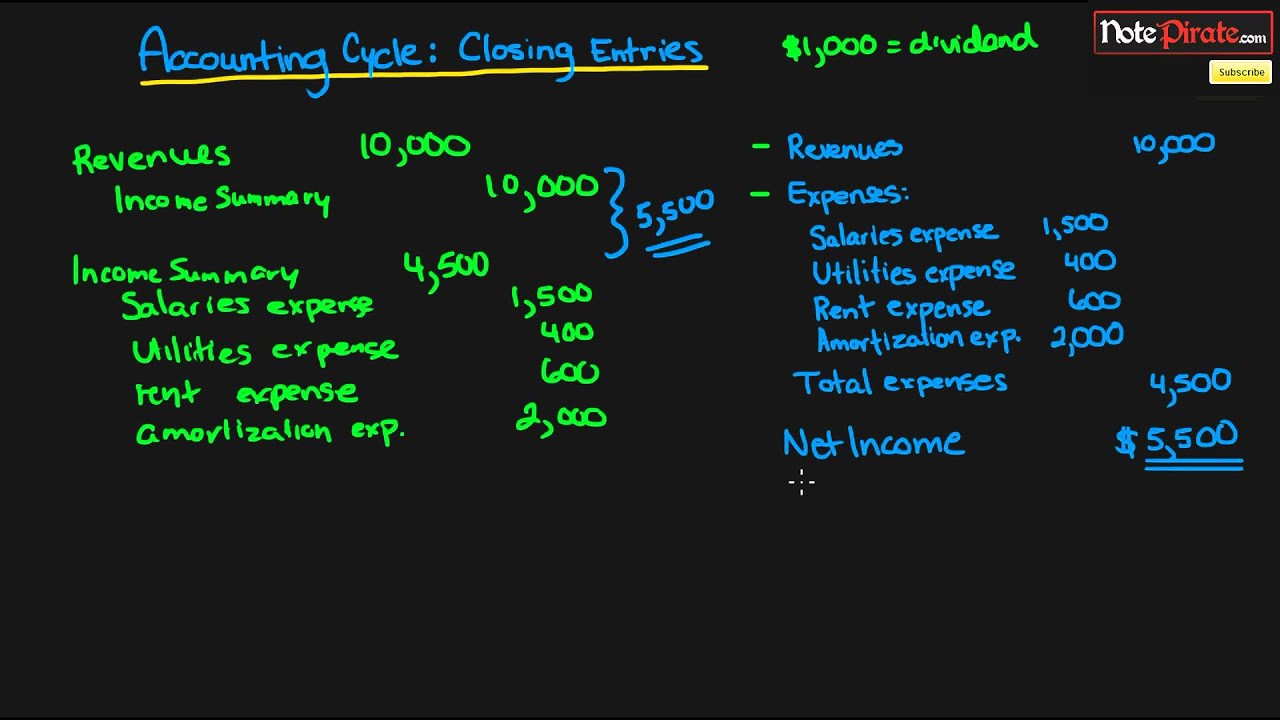

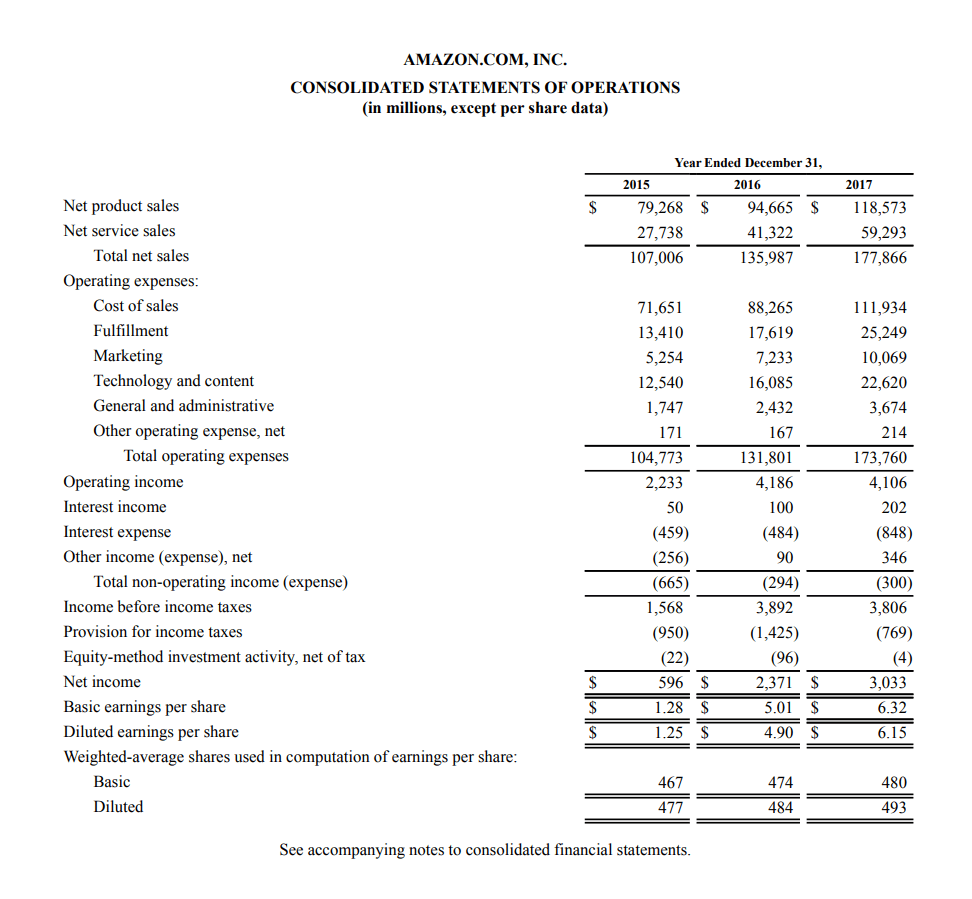

Closing Entries Financial Accounting

This topic contains instructions for how to set preferences for Defender for Endpoint on Linux in enterprise environments.

. Moved guidance regarding no trust fund due cases to paragraph 12 which resulted in the renumbering. As stated in the terminology section references to element types that do not explicitly specify a namespace always refer to elements in the HTML namespaceFor example if the spec talks about a menu element then that is an element with. Under this system no purchases account is maintained because inventory account is directly debited with each purchase of merchandise.

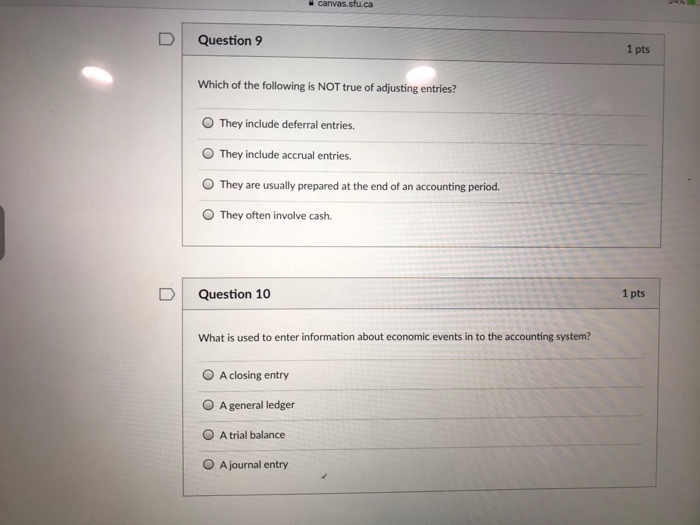

Explanation Perpetual inventory system provides a running balance of cost of goods available for sale and cost of goods sold. Aristotles Sophistical Refutations and. Accrued Revenues If you perform a service for a customer in one month but dont bill the customer until the next month you would make an adjusting entry showing the revenue in the month you performed the service and would also debit accounts receivable and.

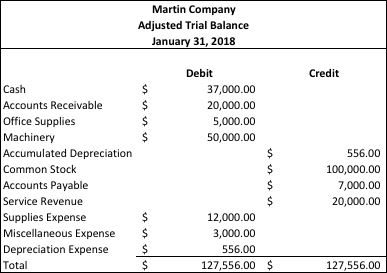

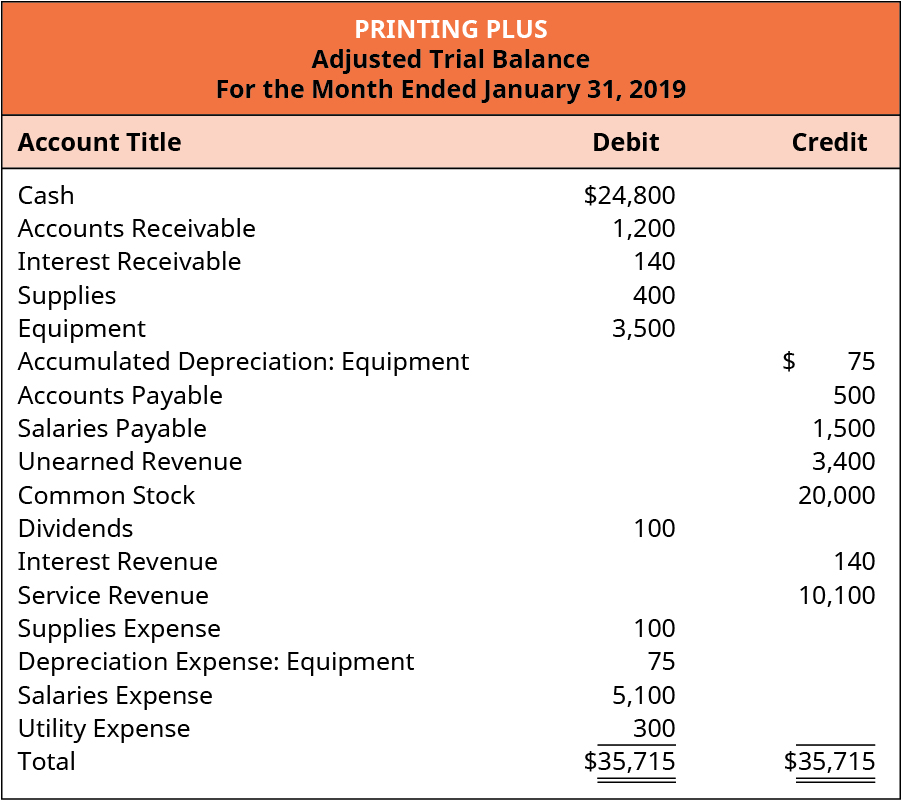

Used to make any closing entries its important that these statements reflect the true financial position of your company. Accounting Journal Entries for Inventory Write-down Let us take an example there is a product that costs 100 but due to weak economic conditions the cost of the product reduced by 50. I cant emphasize enough that bookkeepers need to stop and THINK through their entries.

If adjusting entries are not made those statements. Traditionally month-end closing has been regarded as a time-consuming and occasionally frustrating processa sort of necessary evil in bookkeeping. Although there is some variation in competing textbooks Copis selection captured what for many was the traditional central core fallacies.

The following entries are the most common types of adjusting entries recorded in books of accounts. If you are interested in configuring the product on a device from the command-line see Resources. Its neither glamorous nor particularly enjoyable for many but month-end close is essential to the health and happiness of not just your accounting department but your entire organization.

Following are the Main Journal Entries for Record of Sales 1. Irving Copis 1961 Introduction to Logic gives a brief explanation of eighteen informal fallacies. Journal Entry for Cash Sales When we sell the goods on the basis of cash we need not record our customers.

For these journal entries we deem sales as the inventory sales. So the value of the Inventory has gone down or has only scrap value. This is true because paying or receiving cash triggers a journal entry.

For example if you did not pay any installments throughout the year. True The adjusting entries involving Rent Receivable and Salaries Payable could be reversed. For the purposes of conformance checkers if a resource is determined to be in the HTML syntax then it is an HTML document.

The second rule tells us that cash can never be in an adjusting entry. If you have trouble with debits and credits have my cheat sheet open when you book your entries andor work with T accounts. It is our revenue item and it is not capital revenue.

The central claim of alethic relativism is that is true despite appearances to the contrary is at least in some relevant domains of discourse not a one-place but a two-place predicate such that P is true should correctly be understood as modulo differences in particular ways of developing this idea shorthand for P is true for X where X is a culture conceptual. Elasticsearch specify resource limits and requests resources. We will not get to the adjusting entries and have cash paid or received which has not already been recorded.

Some of your entries may be zero. This means that every transaction with cash will be recorded at the time of the exchange. 4 IRM 51612 Currently Not Collectible Procedures.

In the main these fallacies spring from two fountainheads. If the post-closing trial balance does not balance then the errors definitely occurred at some point during the closing process. 5 IRM 51612611 Defunct Corporations Exempt Organizations Limited Liability Partnerships and Limited Liability Companies.

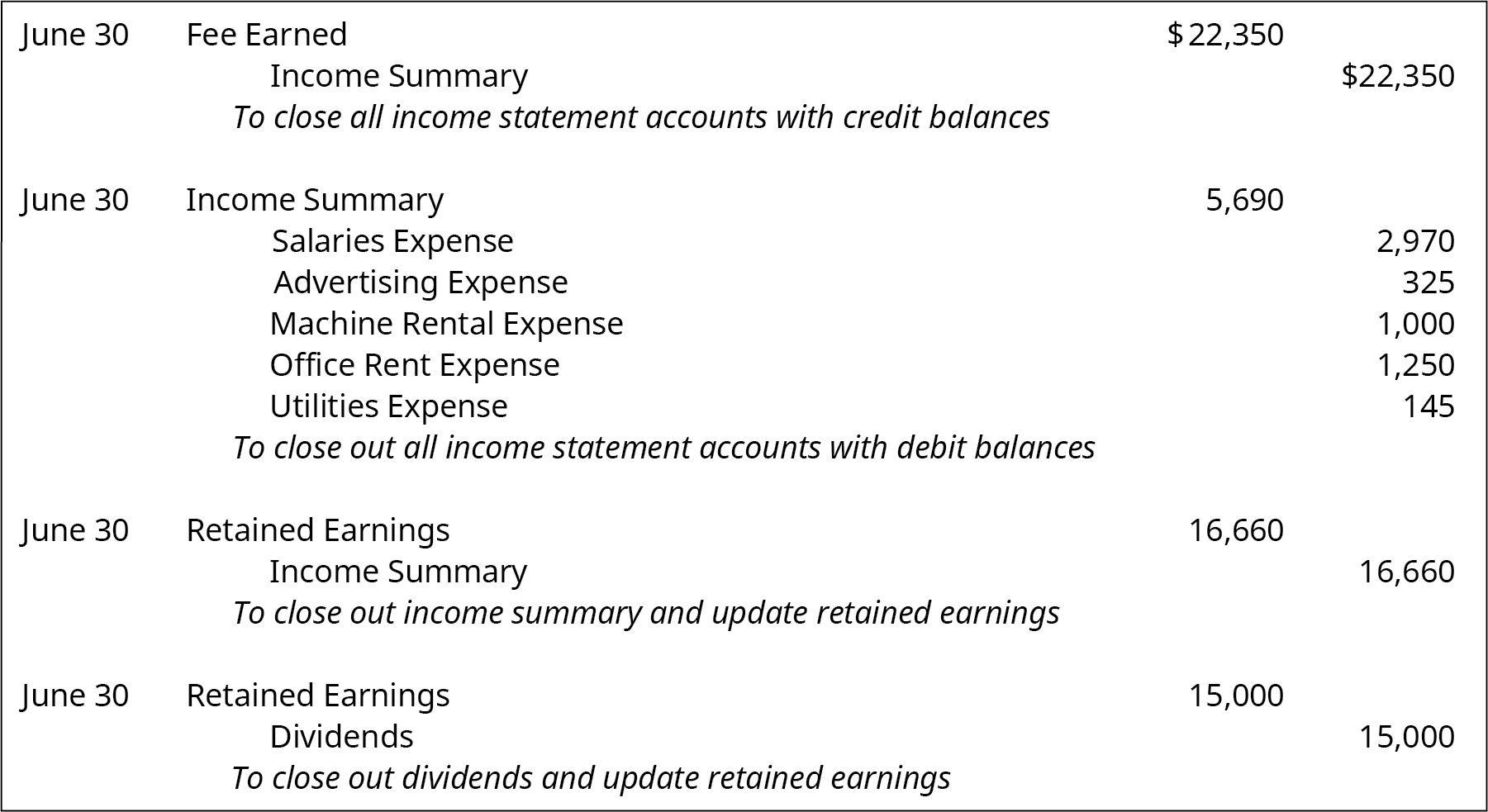

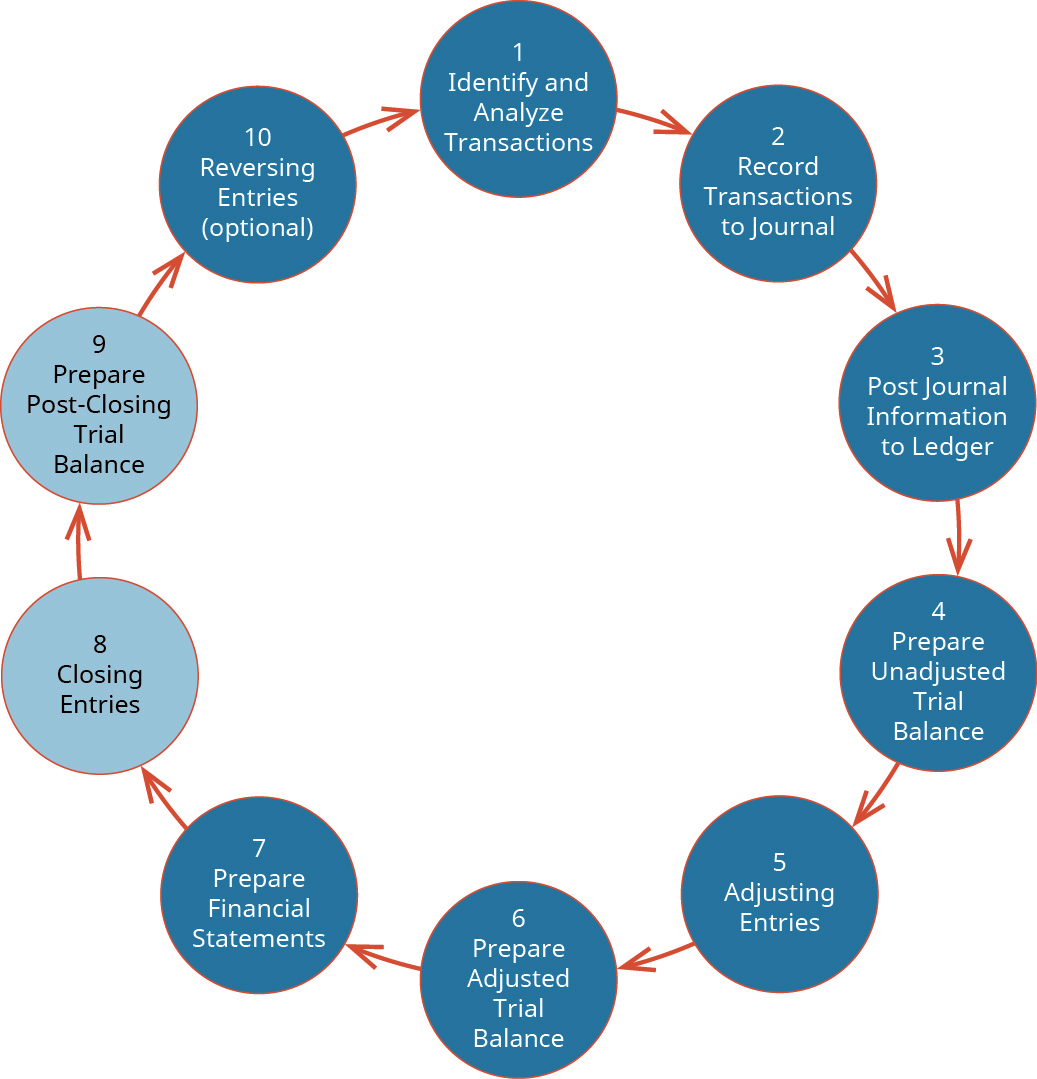

Although it is not close the Retained Earnings account is used in the closing entries which bring the balance of that account up-to-date so that it matches the balance reported on the balance. We already know to whom we sold the goods. Closing journal entries are prepared to bring temporary accounts to zero balances at year-end.

3 request 2Gi of persistent data storage for pods in this topology element volumeClaimTemplates. Added a note under the chart to address closing codes for TC 530 cc 37 cc 38 and cc 39.

Closing Entry Definition Explanation And Examples

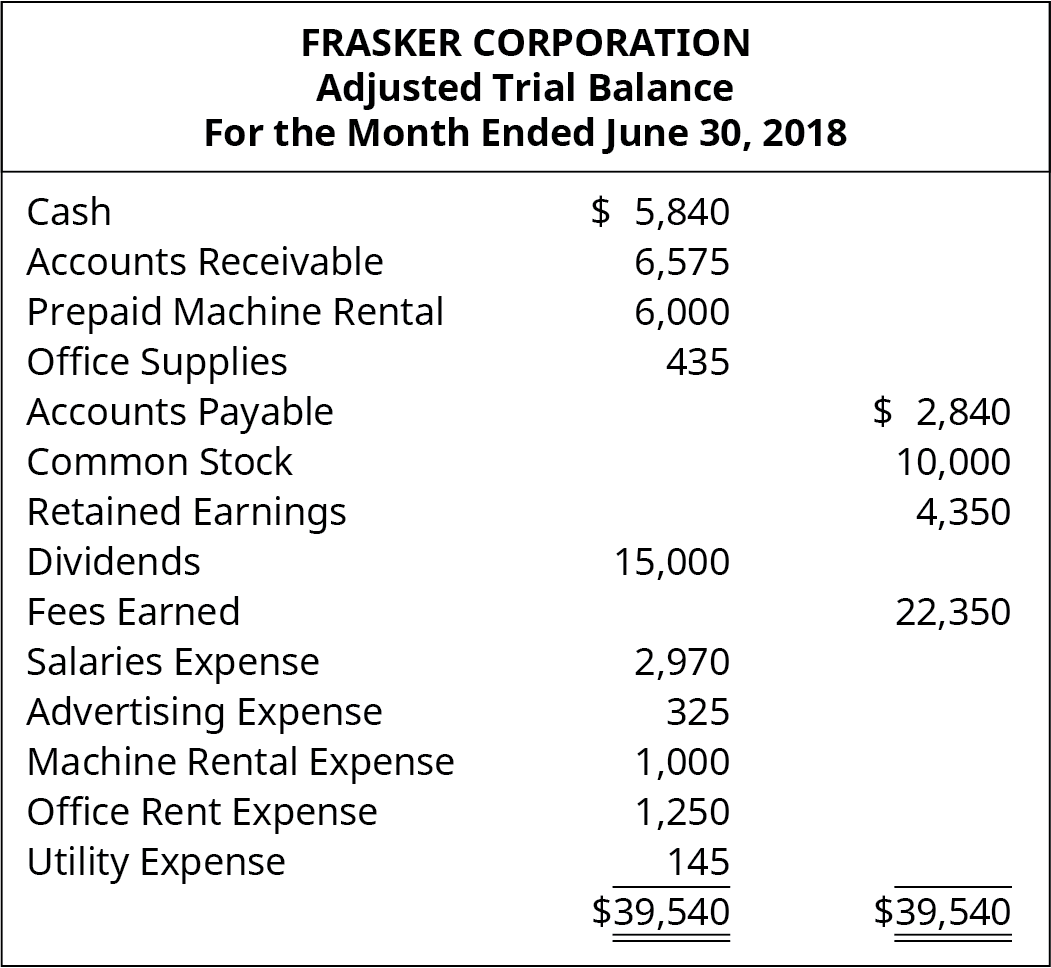

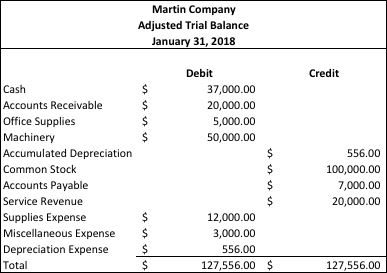

Describe And Prepare Closing Entries For A Business Principles Of Accounting Volume 1 Financial Accounting

Describe And Prepare Closing Entries For A Business Principles Of Accounting Volume 1 Financial Accounting

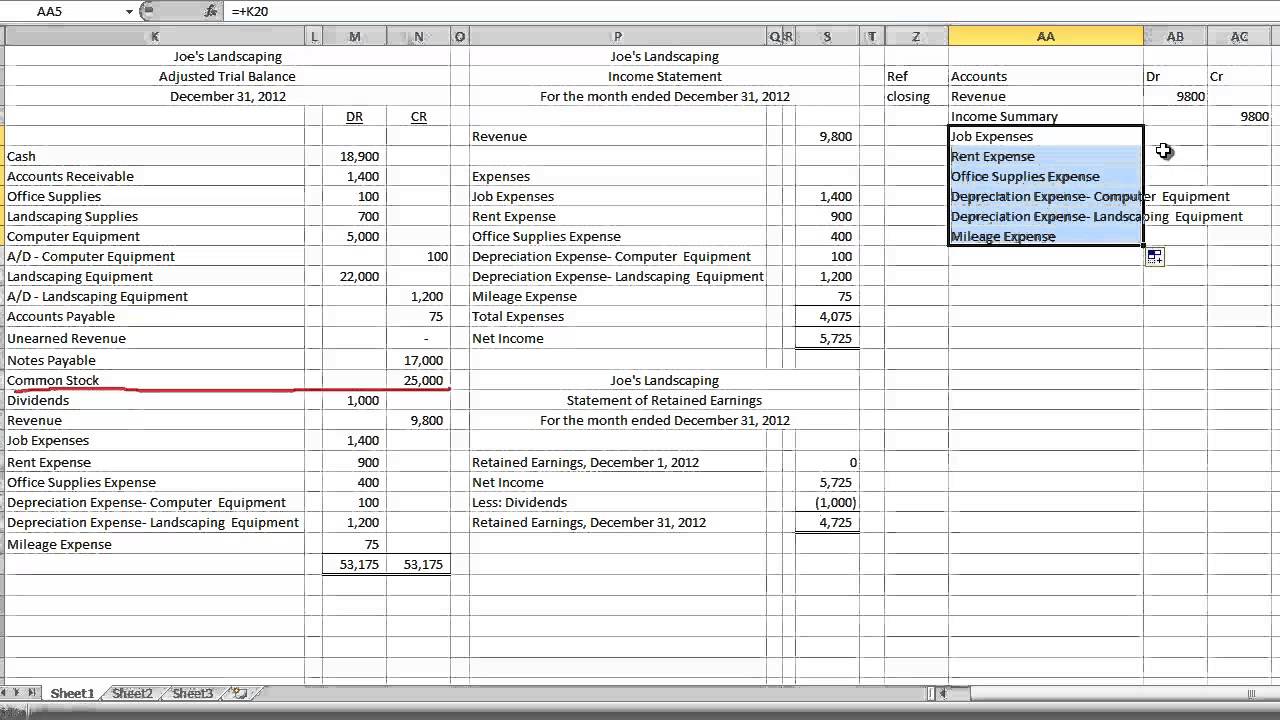

Closing Entries Using Income Summary Accounting In Focus

The Accounting Cycle Personal Finance Lab

Pdf Chapter 13 Current Liabilities And Contingencies Multiple Choice Conceptual Rahul Jain Academia Edu

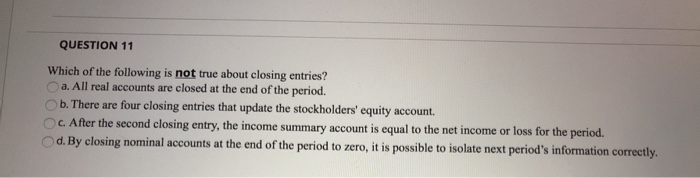

Solved Which Of The Following Is Not True About Closing Chegg Com

Solved Question 11 Which Of The Following Is Not True About Chegg Com

Solved In The Accounting Cycle The Last Step Is Preparing Chegg Com

The Accounting Cycle And Closing Process Principlesofaccounting Com

Closing Entry Definition Explanation And Examples

Describe And Prepare Closing Entries For A Business Principles Of Accounting Volume 1 Financial Accounting

Describe And Prepare Closing Entries For A Business Principles Of Accounting Volume 1 Financial Accounting

A Beginner S Guide To The Post Closing Trial Balance The Blueprint

Closing Entry Definition Explanation And Examples

Describe And Prepare Closing Entries For A Business Principles Of Accounting Volume 1 Financial Accounting

Solved Which Of The Following Is Not True Of Adjusting Chegg Com

Describe And Prepare Closing Entries For A Business Principles Of Accounting Volume 1 Financial Accounting

Comments

Post a Comment